Which Of The Following Is Not A Tool Available To The Fed To Change The Supply Of Money

Introduction

The Fed, every bit the nation's monetary policy say-so, influences the availability and cost of money and credit to promote a healthy economy. Congress has given the Fed two coequal goals for monetary policy: first, maximum employment; and, second, stable prices, meaning depression, stable inflation. This "dual mandate" implies a third, bottom-known goal of moderate long-term interest rates.

The Fed'south interpretations of its maximum employment and stable prices goals take inverse over time as the economy has evolved. For example, during the long expansion after the Great Recession of 2007–2009, labor market conditions became very strong and yet did not trigger a meaning ascension in inflation. Accordingly, the Fed de-emphasized its prior concern nigh employment possibly exceeding its maximum level, focusing instead only on shortfalls of employment beneath its maximum level. In this newer interpretation, formalized in the FOMC'south August 2020 "Statement on Longer-Run Goals and Monetary Policy Strategy," high employment and low unemployment exercise non raise concerns for the FOMC equally long as they are not accompanied past unwanted increases in inflation or the emergence of other risks that could threaten attainment of the dual mandate goals.

More than by and large, maximum employment is a broad-based and inclusive goal that is not directly measurable and is affected by changes in the structure and dynamics of the labor market. So, the Fed doesn't specify a fixed goal for employment. Its assessments of the shortfalls of employment from its maximum level residuum on a wide range of indicators and are necessarily uncertain. Intuitively, though, when the economy is at maximum employment, anyone who wants a job can get 1. And contempo estimates of the longer-run charge per unit of unemployment that is consistent with maximum employment are more often than not around four percent.

Fed policymakers judge that a 2 percent aggrandizement rate, every bit measured by the annual change in the toll index for personal consumption expenditures, is most consequent over the longer run with its mandate for stable prices. The Fed began explicitly stating the ii percent goal in 2012. In its 2020 "Argument on Longer-Run Goals and Monetary Policy Strategy," the FOMC inverse that goal to inflation that averages ii percent over time, in contrast to aiming for 2 per centum at any given fourth dimension. And then, following periods when aggrandizement has persisted below 2 percent, the Fed strives for inflation to be moderately above two percent for some fourth dimension.

Setting Monetary Policy: The Federal Funds Rate

The federal funds charge per unit is the interest rate that fiscal institutions charge each other for loans in the overnight market place for reserves.

The Fed implements budgetary policy primarily by influencing the federal funds rate, the interest rate that fiscal institutions charge each other for loans in the overnight market for reserves. Fed monetary policy deportment, described beneath, affect the level of the federal funds charge per unit. Changes in the federal funds rate tend to cause changes in other curt-term interest rates, which ultimately affect the cost of borrowing for businesses and consumers, the full amount of money and credit in the economy, and employment and inflation.

To go on price inflation in check, the Fed can use its budgetary policy tools to raise the federal funds rate. Monetary policy in this case is said to "tighten" or become more "contractionary" or "restrictive." To beginning or opposite economic downturns and eternalize inflation, the Fed tin use its monetary policy tools to lower the federal funds rate. Budgetary policy is then said to "ease" or become more "expansionary" or "accommodative."

Implementing Monetary Policy: The Fed's Policy Toolkit

The Fed has traditionally used three tools to conduct monetary policy: reserve requirements, the discount rate, and open market operations. In 2008, the Fed added paying interest on reserve balances held at Reserve Banks to its monetary policy toolkit. More than recently the Fed also added overnight reverse repurchase agreements to support the level of the federal funds rate.

Reserve Requirements

The Federal Reserve Human activity of 1913 required all depository institutions to set aside a percentage of their deposits as reserves, to be held either as greenbacks on mitt or as account balances at a Reserve Banking company. The Act gave the Fed the authority to set up that required percentage for all commercial banks, savings banks, savings and loans, credit unions, and U.S. branches and agencies of foreign banks. These institutions typically have an account at the Fed and use their reserve balances to meet reserve requirements and to process financial transactions such as cheque and electronic payments and currency and coin services.

For most of the Fed's history, monetary policy operated in an environs of "deficient" reserves. Banks and other depository institutions tried to keep their reserves close to the bare minimum needed to meet reserve requirements. Reserves above required levels could be loaned out to customers. So, by moving reserve requirements, the Fed could influence the amount of banking company lending. Promoting budgetary policy goals through this aqueduct wasn't typical though.

Still, reserve requirements have played a central function in the implementation of monetary policy. When reserves weren't very abundant, there was a relatively stable level of need for them, which supported the Fed'southward power to influence the federal funds rate through open market operations. The demand for reserves came from reserve requirements coupled with reserve scarcity. If a bank was at risk of falling short on reserves, it would borrow reserves overnight from other banks. As mentioned in a higher place, the involvement rate on these short-term loans is the federal funds rate. Stable need for reserves allowed the Fed to predictably influence the federal funds rate—the price of reserves—by irresolute the supply of reserves through open market place operations.

During the 2007–2008 financial crisis, the Fed dramatically increased the level of reserves in the banking system when it expanded its rest sail (covered in more item beneath). Since that time, budgetary policy has been operating in an "ample" reserves environment, where banks have had many more reserves on manus than were needed to meet their reserve requirements.

In this aplenty reserves environs, reserve requirements no longer play the aforementioned office of contributing to the implementation of monetary policy through open market operations. In 2020, then, the Federal Reserve reduced reserve requirement percentages for all depository institutions to zip.

The Discount Rate

The discount rate is the interest rate a Reserve Bank charges eligible fiscal institutions to borrow funds on a short-term basis—transactions known as borrowing at the "discount window." The discount rate is set by the Reserve Banks' boards of directors, subject to the Board of Governors' approval. The level of the discount charge per unit is fix above the federal funds rate target. Every bit such, the discount window serves as a backup source of funding for depository institutions. The discount window can too go the primary source of funds under unusual circumstances. An example is when normal functioning of financial markets, including borrowing in the federal funds market, is disrupted. In such a instance, the Fed serves as the lender of last resort, 1 of the classic functions of a cardinal bank. This took place during the financial crunch of 2007–2008 (equally detailed in the Fiscal Stability section).

Open Market Operations

Traditionally, the Fed's most frequently used monetary policy tool was open market operations. This consisted of ownership and selling U.South. regime securities on the open market, with the aim of adjustment the federal funds rate with a publicly announced target set past the FOMC. The Federal Reserve Banking concern of New York conducts the Fed's open market operations through its trading desk.

If the FOMC lowered its target for the federal funds rate, so the trading desk in New York would purchase securities on the open market place to increase the supply of reserves. The Fed paid for the securities by crediting the reserve accounts of the banks that sold the securities. Because the Fed added to reserve balances, banks had more than reserves that they could and so convert into loans, putting more money into circulation in the economy. At the same time, the increase in the supply of reserves put downward pressure on the federal funds rate co-ordinate to the basic principle of supply and need. In plough, brusk-term and long-term market interest rates directly or indirectly linked to the federal funds charge per unit as well tended to autumn. Lower interest rates encourage consumer and business concern spending, stimulating economical activity and increasing inflationary pressure.

On the other mitt, if the FOMC raised its target for the federal funds rate, then the New York trading desk would sell government securities, collecting payments from banks by withdrawing funds from their reserve accounts and reducing the supply of reserves. The refuse in reserves put upwards pressure on the federal funds charge per unit, over again according to the bones principle of supply and need. An increment in the federal funds rate typically causes other marketplace interest rates to rise, which damps consumer and business concern spending, slowing economic activity and reducing inflationary force per unit area.

Involvement on Reserves

The involvement charge per unit paid on excess reserves acts similar a flooring beneath the federal funds charge per unit.

As a event of the Fed's efforts to stimulate the economic system following the 2007–2008 financial crisis, the supply of reserves in the banking organisation grew very large. The amount is so large that near banks have many more reserves than they need to meet reserve requirements. In an environment with a superabundance of reserves, traditional open up market operations that modify the supply of reserves are no longer sufficient for adjusting the level of the federal funds rate. Instead, the target level of the funds charge per unit can be supported by changing the interest rate paid on reserves that banks hold at the Fed.

In October 2008, Congress granted the Fed the authority to pay depository institutions involvement on reserve balances held at Reserve Banks. This includes paying interest on required reserves, which is designed to reduce the opportunity cost of holding required reserve balances at a Reserve Bank. The Fed tin as well pay interest on excess reserves, which are those balances that exceed the level of reserves banks are required to hold. The interest rate paid on excess reserves acts like a flooring beneath the federal funds charge per unit because most banks would not exist willing to lend out their reserves at rates below what they can earn with the Fed.

Overnight Reverse Repurchase Agreements

The interest rate on reserves is a crucial tool for managing the federal funds rate. Notwithstanding, some financial institutions lend in overnight reserve markets but aren't allowed to earn interest on their reserves, then they are willing to lend at a rate below the interest on reserves rate. This primarily includes government-sponsored enterprises and Federal Home Loan Banks.

To account for such transactions and support the level of the federal funds rate, the Fed also uses fiscal arrangements called overnight opposite repurchase agreements. In an overnight contrary repurchase agreement, an institution buys securities from the Fed, then the Fed buys the securities back the side by side day at a slightly college price. The institution that bought the securities the day before earns involvement through this procedure. These institutions take picayune incentive to lend in the federal funds market at rates much below what they can earn by participating in a opposite repurchase understanding with the Fed. Past irresolute the involvement rate paid in opposite repurchase agreements, in addition to the rate paid on reserves, the Fed is able to improve command the federal funds rate.

In Dec 2015, when the FOMC began increasing the federal funds rate for the starting time time later the 2007–2008 fiscal crisis, the Fed used interest on reserves, as well as overnight opposite repurchase agreements and other supplementary tools. The FOMC has stated that the Fed plans to apply the supplementary tools only every bit they are needed to help command the federal funds rate. Interest on reserves remains the primary tool for influencing the federal funds rate, other market involvement rates in turn, and ultimately consumer and business borrowing and spending.

Nontraditional and Crunch Tools

When faced with severe disruptions, the Fed can plow to additional tools to support financial markets and the economy. The recession that followed the 2007–2008 financial crisis was so severe that the Fed used open marketplace operations to lower the federal funds rate to near zero. To provide additional support, the Fed also used tools that were not part of the traditional toolkit to lower borrowing costs for consumers and businesses. 1 of these tools was purchasing a very large corporeality of assets such as Treasury securities, federal bureau debt, and federal agency mortgage-backed securities. These asset purchases put additional downward force per unit area on longer-term involvement rates, including mortgage rates, and helped the economy recover from the deep recession. In addition, the Fed opened a series of special lending facilities to provide much-needed liquidity to the financial organization. The Fed also announced policy plans and strategies to the public, in the form of "forward guidance." All of these efforts were designed to help the economic system through a difficult menstruation.

Recently, the Fed responded to the COVID-19 pandemic with its full range of tools, to support the menstruum of credit to households and businesses. This included both traditional tools and an expanded gear up of not-traditional tools. The traditional tools included lowering the target range for the federal funds rate to near zero and encouraging borrowing through the discount window, in add-on to lowering the discount charge per unit and increasing the length of time available to pay dorsum loans. On the non-traditional side, the Fed purchased a large corporeality of Treasuries and agency mortgage-backed securities, and opened a fix of lending facilities under its emergency lending authority that is fifty-fifty broader than what was established during the crunch a dozen years earlier. These tools are designed to support stability in the financial arrangement and bolster the implementation of monetary policy by keeping credit flowing to households, businesses, nonprofits, and state and local governments.

The Fed'south Remainder Canvas

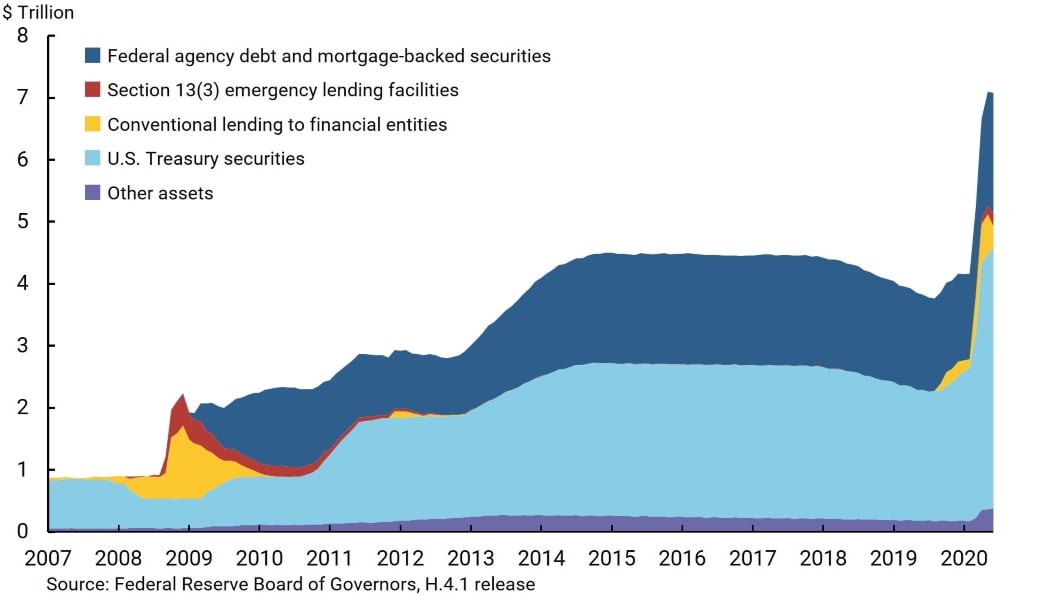

A chart of the Fed'due south balance sheet is available below and provides details on five broad categories of assets, including 1) U.Due south. Treasury securities; 2) federal bureau debt and mortgage-backed securities; iii) conventional lending to fiscal entities; 4) emergency lending facilities authorized under Section 13(3) of the Federal Reserve Act; and 5) other assets.

Equally shown in the chart, the Fed'south balance sheet has expanded and contracted over time. During the 2007–08 financial crisis and subsequent recession and recovery, total assets increased significantly from approximately $870 billion before the crisis to $four.5 trillion in early 2015. So, reflecting the FOMC's balance sheet normalization programme that took place between October 2017 and August 2019, full avails declined to under $3.8 trillion. Beginning in September 2019, full assets started to increase again, reflecting responses to disruptions in the overnight lending market place. The well-nigh contempo increase, beginning in March 2020, reflects the Fed'southward efforts to support financial markets and the economy during the COVID-xix pandemic.

Federal Reserve Balance Sheet Assets

Sources:

Factors Affecting Reserve Balances – H.iv.ane, Federal Reserve Board of Governors, July 9, 2020.

FAQs: Money, Interest Rates, and Monetary Policy, Federal Reserve Lath of Governors, March 1, 2017.

Federal Reserve Press Release: Decisions Regarding Monetary Policy Implementation, December sixteen, 2015.

Federal Reserve Printing Release: Federal Reserve Deportment to Back up the Flow of Credit to Households and Businesses, March 15, 2020.

Federal Reserve Printing Release: FOMC argument of longer-run goals and policy strategy, January 25, 2012.

Federal Reserve Press Release: Interest on Reserves, Oct half dozen, 2008.

Federal Reserve Press Release: Policy Normalization Principles and Plans, September 17, 2014.

The Federal Reserve System Purposes & Functions, Federal Reserve Board of Governors, Tenth Edition, Oct 2016.

Federal Reserve'due south Get out Strategy, testimony past Ben Southward. Bernanke, Chairman, Federal Reserve Board of Governors, before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C., March 25, 2010.

The Federal Reserve's Policy Actions during the Financial Crisis and Lessons for the Future, speech communication past Donald L. Kohn, Vice Chairman, Federal Reserve Board of Governors, at the Carleton University, Ottawa, Canada, May thirteen, 2010.

FedPoints: Federal Funds and Interest on Reserves, Federal Reserve Banking company of New York, March 2013.

FedPoints: Open Market Operations, Federal Reserve Bank of New York, August 2007.

Guide to changes in the Statement on Longer-Run Goals and Budgetary Policy Strategy, Federal Reserve Board of Governors, August 27, 2020.

Monetary Policy 101: A Primer on the Fed's Changing Approach to Policy Implementation, by Jane E. Ihrig, Ellen E. Meade, and Gretchen C. Weinbach, Federal Reserve Board of Governors, Finance and Economics Discussion Serial 2015-047, June xxx, 2015.

Reserve Requirements, Federal Reserve Board of Governors, March 20, 2020.

Review of Budgetary Policy Strategy, Tools, and Communications—Q&As, Federal Reserve Board of Governors, August 27, 2020.

Statement on Longer-Run Goals and Monetary Policy Strategy, Federal Reserve Lath of Governors, August 27, 2020.

Summary of Economical Projections, Federal Reserve Board of Governors, June ten, 2020.

Source: https://www.frbsf.org/education/teacher-resources/what-is-the-fed/monetary-policy/

Posted by: owenwonscalun.blogspot.com

0 Response to "Which Of The Following Is Not A Tool Available To The Fed To Change The Supply Of Money"

Post a Comment